placer county sales tax 2020

The base sales tax rate of 725 consists of several components. Placer County CA Sales Tax Rate.

Retailers are taxed for the opportunity to sell tangible items in California.

. B Three states levy mandatory statewide local add-on sales taxes at the state level. The current total local sales tax rate in Placer County CA is 7250. ICalculator US Excellent Free Online Calculators for Personal and Business use.

Acton 9500 Los Angeles Adelaida. The total sales tax rate in any given location can be broken down into state county city and special district rates. Retailers typically pass this tax along to buyers.

The December 2020 total local sales tax rate was also 7750. The sales tax is assessed as a percentage of the price. What is the sales tax rate in Placerville California.

If this rate has been updated locally please contact us and we will update the sales tax rate for Placer County California. To calculate the sales tax amount for all other values use our sales tax calculator above. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 731 in Placer County California.

Just enter the five-digit zip code of the location. What is the sales tax rate in Placer County. The main increment is the state-imposed basic sales tax rate of 6.

The minimum combined 2022 sales tax rate for Placerville California is. A capacity crowd attended a meeting at Old Town Pizza in Lincoln last night to hear officials of the Placer County Transportation Planning Agency address the projects that are in planning and or under construction stages in South. All numbers are rounded in the normal fashion.

The California sales tax rate is currently. A City county and municipal rates vary. Director Of Health Human Services Placer County 2020.

Rates Effective 04012020 through 06302020. This is the total of state and county sales tax rates. Home News Local News Sales Tax Increase For Lower Placer County Cities to Pay For Transportation.

Maximum Local Sales Tax. This table shows the total sales tax rates for all cities and towns in Placer. The Placer County California sales tax is 725 the same as the California state sales tax.

The December 2020 total local sales tax rate was also 7750. A yes vote supported authorizing an additional sales tax of 1 for 7 years generating an estimated 256 million per year for general services including law enforcement fire services and code enforcement services thereby increasing the total sales. California has a 6 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes.

The current total local sales tax rate in Roseville CA is 7750. Treasurer - Tax Collector Placer County 2020. Auditor - Controller Placer County 2020.

Tamal San Quentin 8000. This is the total of state and county sales tax rates. Tarzana Los Angeles 9500.

Placer County could vote on half-cent sales tax for Highway 65 improvements. Sales tax in Placer County California is currently 725. The 2018 United States Supreme Court decision in South Dakota v.

Check out information and services such as online payments finding your tax rate and setting up auto payments. California 1 Utah 125 and Virginia 1. The December 2020 total local sales tax rate was also 7250.

State Local Sales Tax Rates As of January 1 2020. Average Local State Sales Tax. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

It was defeated. This table shows the total sales tax rates for all cities and towns in Placer. Sales Tax Table For Placer County California.

Thats why the planning agency wants voters to decide on a half-cent. The December 2020 total local sales tax rate was also 7250. These rates are weighted by population to compute an average local tax rate.

Puerto Rico has a 105 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes. The sales tax rate for Placer County was updated for the 2020 tax year this is the current sales tax rate we are using in the Placer County California Sales Tax Comparison Calculator for 202122. Next to city indicates incorporated city City Rate County Acampo.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The County sales tax rate is. By BStigers on February 29 2020.

California State Sales Tax. The Placerville sales tax rate is. Exceptions include services most groceries and medicine.

Deputy District Attorney - Supervising Placer County 2020. 936 PM PST February 26 2020. 1 Page.

Roseville CA Sales Tax Rate. This is the total of state county and city sales tax rates. Maximum Possible Sales Tax.

Douglas E van Breemen. The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County. Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer County totaling -025.

The California state sales tax rate is currently. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in which city you are computing the sales tax. The minimum combined 2022 sales tax rate for Placer County California is.

Did South Dakota v. Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer County totaling -025. The main increment is the state-imposed basic sales tax rate.

California City and County Sales and Use Tax Rates. SheriffS Lieutenant Placer County 2020. The Placer County California sales tax is 725 the same as the California state sales tax.

Auburn Measure S was on the ballot as a referral in Auburn on November 3 2020. Clerk of the Board-Property Tax Assessment Appeals. The Placer County sales tax rate is.

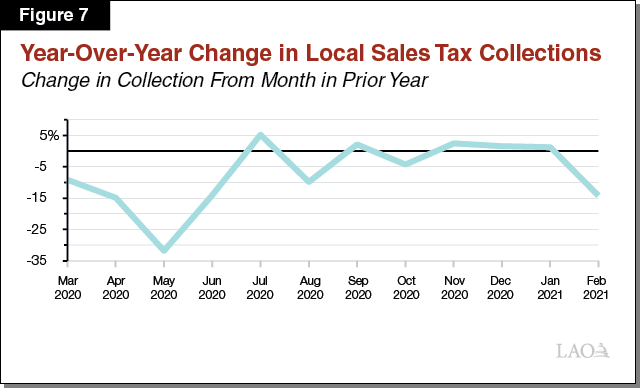

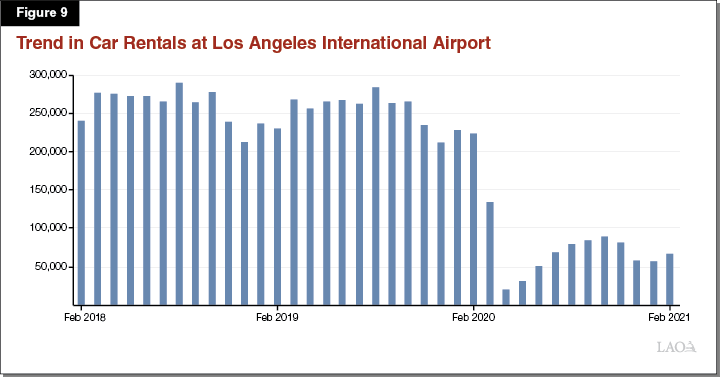

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

Placer County Could Vote On Half Cent Sales Tax Abc10 Com

Tesla Gigafactory Texas Plans Revealed Showing Massive Buildings With Interesting Shape Tesla How To Plan Electric Pickup Truck

Modern Outdoor Two Tiered Concrete Water Fountain Giannini Garden Ornaments Carrara Ball Garden Fountains Stone Garden Fountains Fountain

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

New 2020 Riverside Rv Retro 169 Travel Trailer At Rv Travel World Roseville Ca 17418 Travel Trailer Retro Travel Trailers Riverside

Foreign Private Issuer Registration F 1 A

Tesla S First Full Battery Cell Factory Will Produce Up To 250 Gwh Roughly The Current World Capacity Full Battery Tesla Cell

The Quintessential Portland Gardener Drought Tolerant Landscape Front Yard Xeriscape Front Yard Privacy Landscaping